We underwrite meme‑coin launches on Solana and issue NFT policies that trigger a conditional buyback if agreed metrics are not met. Less rugs. More confidence.

Join our CEO live on Twitter Spaces for an AMA session. Insights on CanaryMint’s launch and $CANARY token.

Creators apply for underwriting and agree to transparent launch rules.

On‑chain checks, contract screening, social activity, and anti‑sybil analysis.

LP lock, team vesting, supply constraints, and KPI oracles are finalized on‑chain.

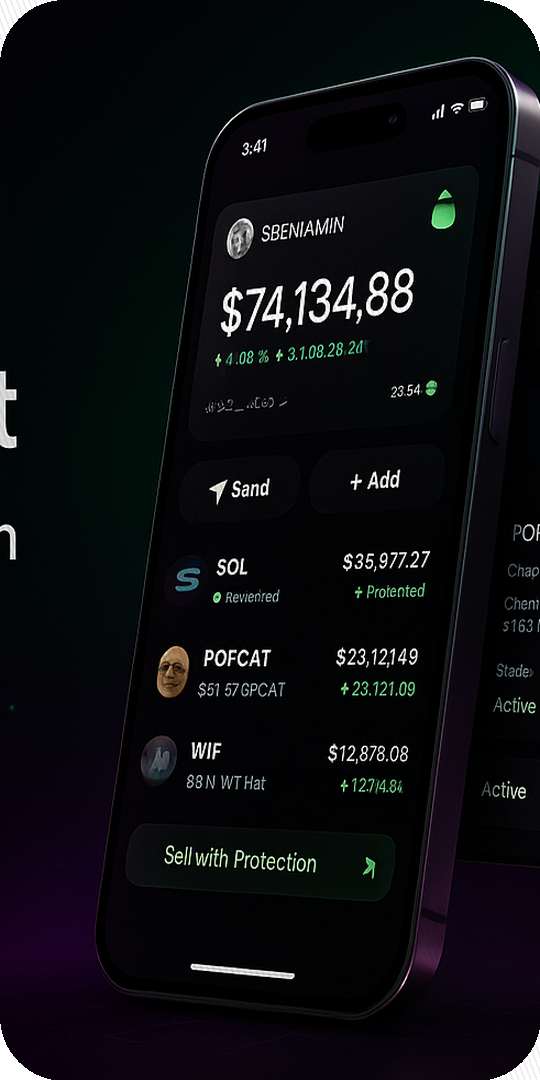

Users buy via Blink; an NFT Policy is minted to their wallet automatically.

If KPIs aren’t met or rules are violated, the agent executes a partial buyback in SOL/USDC.

Enter early with guardrails. Every protected purchase mints an NFT Policy that locks in your coverage window and terms.

{

"policy": "CMNT-3F92…",

"coverage": "up to 40%",

"term_days": 7,

"kpi": ["Volume ≥ threshold", "LP locked", "Organic holders ≥ X%"],

"oracle": "multi‑source KPI feeds",

"payout": "auto buyback in SOL/USDC"

}

Get your launch underwritten and earn trust from day one. Qualifying projects receive the “Protected Launch” badge and initial liquidity support.

$CANARY will power discounts for policies, access to private cohorts, and shared upside from underwriting fees. The contract address will be posted on our Twitter.

Crypto assets are risky. Nothing on this site is financial advice. Coverage is limited to policy terms. Read all documentation before purchasing.

We underwrite launches and issue NFT policies that define objective conditions for a partial buyback if KPIs are missed or rules are violated.

From an underwriting reserve funded by policy fees and platform revenue, subject to per‑launch exposure limits.

It’s an on‑chain protection policy with predefined conditions and caps. Terminology avoids regulated insurance language and focuses on performance obligations.

They pass risk checks and agree to LP lock, vesting, and other safeguards. Terms are recorded on‑chain for transparency.

On our official Twitter: @canary_mint.